salt tax cap removal

The SALT deduction benefits only a shrinking minority of taxpayers. It limits the deduction for property taxes and state income or sales taxes to.

Democrats Salt Tax Fix Could Come With New Minimum Tax On Upper Income Households The Washington Post

Responding to reports from yesterday that the State and Local.

/GettyImages-88305470-1--57520b1c5f9b5892e8bfc1a0.jpg)

. Outdoor Family Storytime September 1 2022. Trumps tax law limited SALT deductions to 10000 meaning that residents in higher-tax states like New York and New Jersey could no longer deduct the full value of their. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break.

That jumped to almost 90 for the 2018 tax year the first year of the higher standard deduction and the cap on SALT. The SALT Cap of 10000 was imposed at the federal level in the Tax Cuts and Jobs Act of 2017. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

The relaxed cap an increase from the current 10000 limit would last for a decade until 2031. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax. To review the law put a 10000 cap on the amount taxpayers can deduct from federal returns for their state and local tax payments now commonly referred to as SALT.

Murphy pushing for SALT cap removal isnt willing to make an ultimatum. For this years taxes personal finance firm Kiplinger. WAKANDA 5 IN MOUNT VERNON September 3 2022.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately. By Joey Fox October 20 2021 252 pm. Boss Talks Westchester Meet.

This cap remains unchanged for your 2021 taxes and it will remain the same in. Democratic leaders have been trying to repeal the 10000 cap on so-called SALT deduction since it was introduced in the Trump administrations Tax Cuts and Jobs Act of. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year.

The SALT deal appeared to remove one obstacle to passing the sprawling.

Irs Makes Changes To Tax Capital Reporting Requirements

/GettyImages-88305470-1--57520b1c5f9b5892e8bfc1a0.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Diamond Crystal Iron Fighter Salt Pellets 40 Lb Bag 100012408 At Tractor Supply Co

What Tax Provisions Are In The Senate Passed Inflation Reduction Act Itep

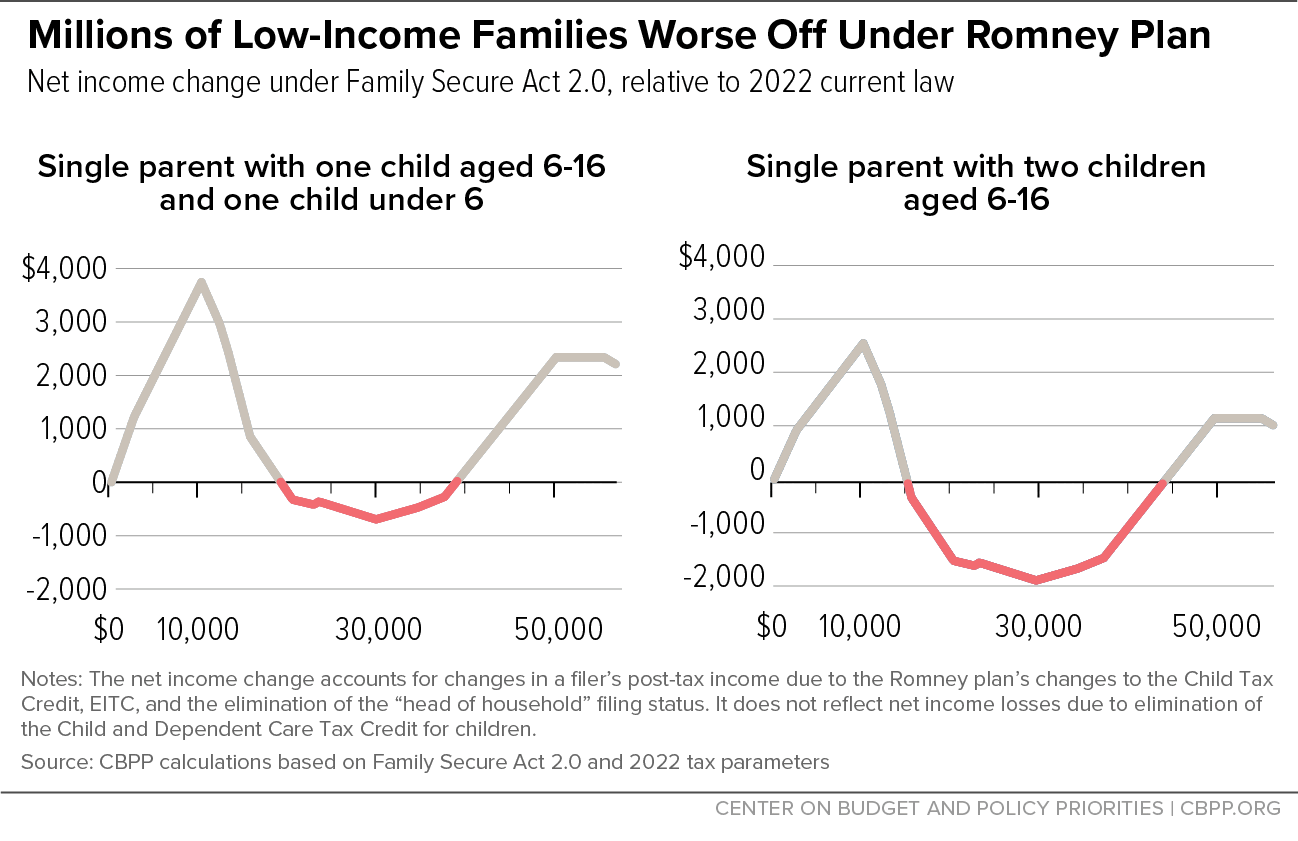

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

What S In The Manchin Schumer Deal On Taxes Climate And Energy Bloomberg

Democrats Are Pushing Tax Breaks For The Rich They Ll Cry When Voters Punish Them David Sirota The Guardian

Recent Arizona Tax Law Changes Beachfleischman Cpas

How To Maximize Your Tax Deductible Donations Forbes Advisor

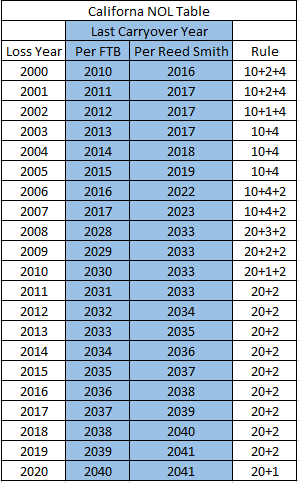

California Governor Removes Net Operating Loss Suspension And Business Credit Cap While Ftb Attempts To Weaken P L 86 272 Protections Perspectives Reed Smith Llp

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

When Is The Best Time To Adjust Your Withholding Tax Forbes Advisor Forbes Advisor

Amazon Com Truegem Stove Gap Covers 25 4 316 Stainless Steel Salt Will Not Corrode Like 304 Stainless Steel Or Aluminum Stovetop To Counter Filler Guard Spills On Countertop 1 Pair Home Kitchen

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Minnesota S New Passthrough Entity Tax Olsen Thielen Cpas Advisors

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Nc Budget Allows Ppp Deductions Reduces Tax Rates More

Salt Cap Democrats Sneaking In Tax Cut For Wealthy Into Build Back Better Plan